Hand-Up Solutions

Hand-Up Solutions

HOW WE CAN HELP

Strategy and Comparative Advantage

Strategy and Comparative Advantage

- Hand-Up offers students and schools unique products and terms not found anywhere else in the private student finance marketplace.

- Hand-Up’s non-profit status allows it to offer products and services to students that are as economical as federal loans, but with better customer service solutions.

- Hand-Up utilizes best-in-class third-party origination partners that make the application process for students and schools simple and efficient.

- Hand-Up has a highly qualified management team and utilizes seasoned servicing partners to build a compliance environment that could not be replicated at individual schools in a cost-effective manner.

- Hand-Up’s capital structures rely on multiple sources of capital working in synergy to address differing risk tolerances and investment objectives.

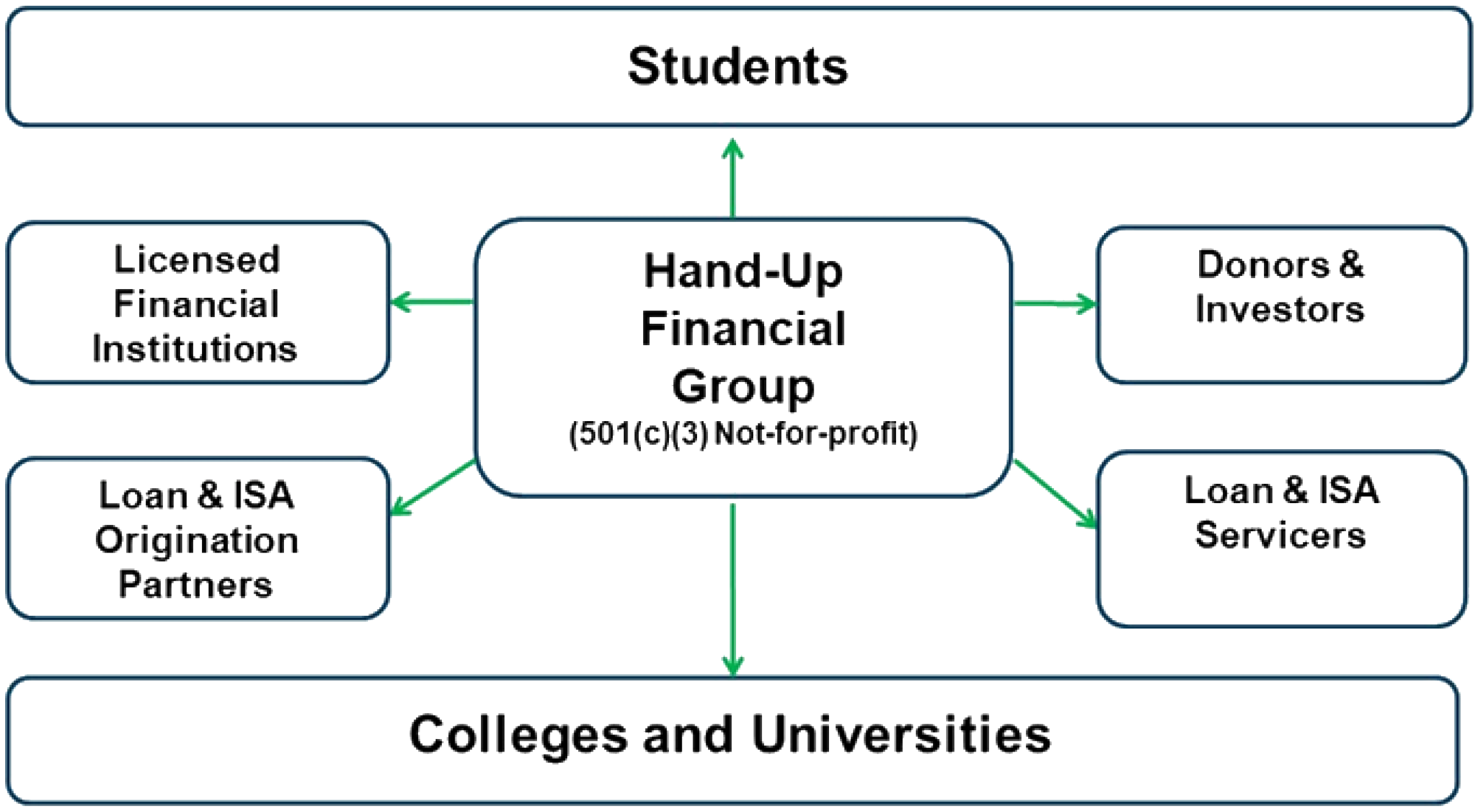

HAND-UP PRIVATE FUNDING PLATFORMS

& PARTNERS

Hand-Up is the only entity that can bring students, schools and investors together to meet common goals.

School, Investor/Donor & Hand-Up – Partnership Value Proposition

School, Investor/Donor & Hand-Up – Partnership Value Proposition

HAND-UP FINANCIAL GROUP:

IMPACT EXAMPLE

The Cycle Can Continue in Perpetuity

- Ability for Investors, Donors and Schools to invest directly in the lives and futures of worthy students

- Investment (net of loss reserves) can be: 100% school funded (nets against loan proceeds); 100% investor funded; or a combination thereof

- School replaces the government by guaranteeing loan program losses (including a funded reserve from loan proceeds equal to 1.5X estimated losses).

- School saves on internal program management staffing that would be required of an institutional loan program.

- Hand-Up manages all origination, servicing, compliance and reporting and costs of third-party providers.

- School and investors both receive a “treasury-like” 2% annual return on their investment in student loan portfolios.

Solutions for Schools

Solutions for Schools

- Hand-Up acknowledges that building and managing a compliant loan/ISA program could be a significant distraction from schools’ core mission: educating students

- Hand-Up enables schools to expand their demographic reach while simultaneously taking small steps on a path to independence from government funding sources

- Hand-Up delivers equal or better cash flows than could be achieved with an institutional loan program.

- Hand-Up allows for the structural complexity and compliance requirements of a loan program to be managed outside of a school.

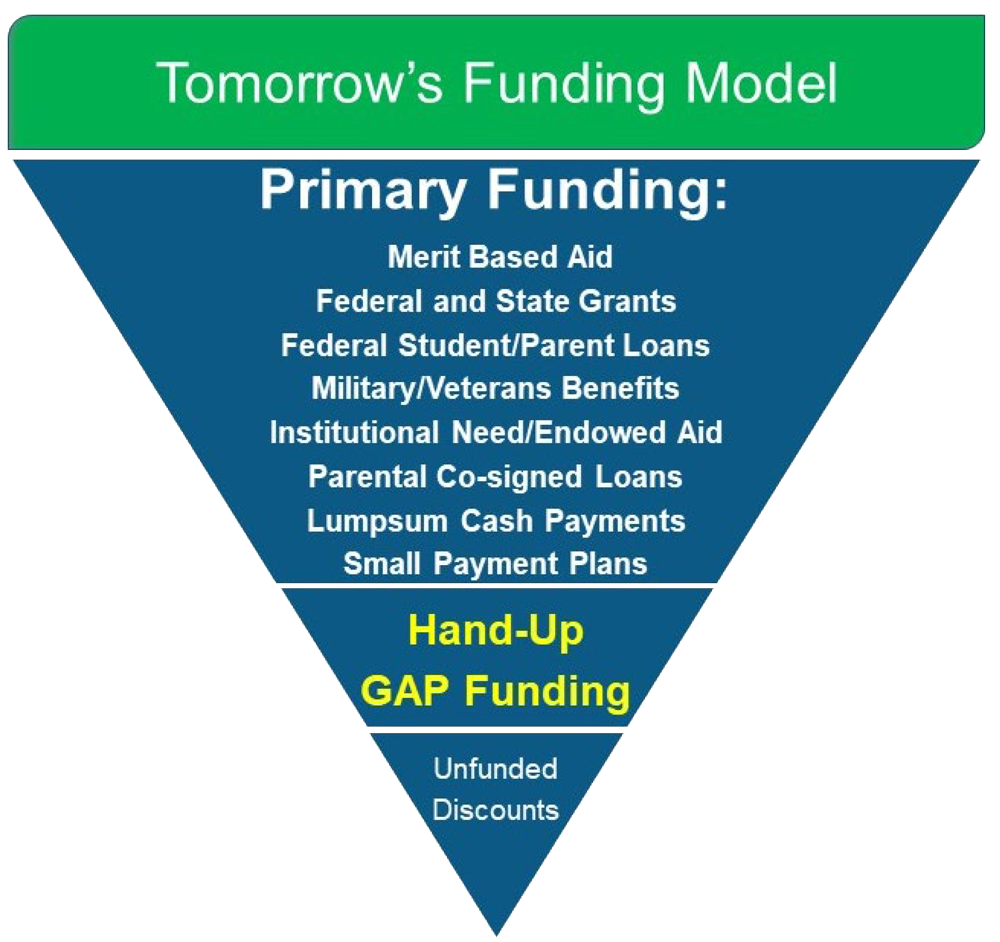

- Hand-Up helps schools looking for additional GAP Funding solutions that will add immediate value to their students, including:

- Increasing access

- Reducing attrition

- Reducing large out-of-pocket or in-school payment obligations

- Increasing the amount of credit loads that can be taken per term (and thereby reducing the time to completion)

Customer Focused Financial Solutions

Customer Focused Financial Solutions

Hand-Up’s GAP Funding solutions level the playing field for underserved students with uniquely designed, privately funded, repayable solutions that are comparable to federal government aid programs offerings to credit-tested parents and grad students. Key design elements include:

- Financial literacy training and other resources help students become successful, self-supporting adults.

- Low in-school payments on loans allow students a chance to establish positive payment habits while also promoting self-discipline, self-determination, and self-confidence well before federal and private loan repayment commences.

- Flexible repayment terms accommodate unforeseen life events.

- Engagement strategies and campaigns assist and motivate the students to keep making payments after separation.